Pre-IPO Trusts: Safeguarding Promoter Wealth and Legacy

Pre-IPO Trusts: Safeguarding Promoter Wealth and Legacy

Know how pre-IPO trust structures help founders de-risk personal balance sheets, avoid family disputes and reserve ESOP pools

- Last Updated

A growing number of promoters are now holding their company shares through trusts. As per Prime Database, as on October 2025, among the 2,757 companies listed on the NSE, promoters of ~880 of these companies hold their shares through different trust structures- private, public or Family Trust driven by the need to safeguard wealth, enhance tax efficiency in case cross border structures, guard assets from creditors in highly leveraged companies, and ease the handover of control for sighting the life uncertainty and health challenges. This practice isn’t unique to India—globally, many of the world’s wealthiest individuals also hold substantial stakes through well-structured trusts. Recent example is purchase of $1 Bn Tesla shares by Elon Musk Revocable Trust.

Capital markets in India have witnessed the presence of private family trusts in Initial Public Offerings (IPOs) increasing visibly in recent times. A study by Fortune India Rich List 2023 shows that 38 billionaires have secured 24.90% of their cumulative wealth (₹32.52 lakh crore) in private trusts. Promoters of renowned companies such as Adani Enterprises, Nykaa, Mankind Pharma, Glenmark, Inspira Enterprises, Welspun, Vedant Fashions (popularly known as Manyavar), and several others have established private family trusts typically holding 50 per cent to 75 per cent stakes, even before listing of the company. On the contrary, Tata Trusts being a public trust holds majority stake of Tata Sons.

Founders work hard for years and undertake risks with the vision to foster their business. Going public is driven by the desire to achieve an enhanced valuation, reputation and credibility in the market. However, it may pose risks for the founder such as dilution of control, additional compliances and decreased role in strategic decisions. Additionally, IPOs raise concerns around personal wealth protection, risks from external claims, family disputes, or the death/incapacity of promoters during the process.

For safeguarding their personal interests and securities, creation of a pre-IPO private trust is a widely chosen practice wherein promoters park their shares of company and family-belonging assets in a trust.

Key market drivers

1. Succession Planning

One of the most common purposes of a private trust is succession planning. Promoters transfer their shareholding prior to an IPO, for the purpose of desirable distribution of such shareholdings among their chosen beneficiaries.

The key concerns weighing on promoters may include:

- Possible pressure to pledge securities.

- Potential claim on assets such from external parties such as creditors due to personal guarantees or professional liabilities getting triggered on default(s) by the company.

- Personal exposure to public and increased scrutiny and with respect to shareholdings, personal assets, etc.

- Disputes related to inheritance among family members.

Private trusts act as a shield to protect these assets and ensure a smooth succession process, helping families avoid such and many more challenges to intergenerational transfer of wealth.

2. Private trusts and Family Business’ IPO

Private trusts may also prove beneficial for family businesses before listing. A private trust allows family businesses to consolidate shareholding in a separate entity, helping to avoid disputes over ownership and any bias over shareholding. In such a setup, directors, promoters and employees are predominantly family members, thus control remains balanced and not fragmented, paving way for a fair and equitable distribution on transfer of wealth across generations.

Typically, assets primarily owned by family and used in the family business, are transferred to the trust before listing ensuring such assets remain free from any business claim and family retains control and ownership.

3. Trusts for the Benefit of Employees

Another common reason for creation of trusts, is for the consolidation of stock options granted or to be granted to employees of the company. Housing these shares within a trust help in segregation of shares from the overall quantum and demarcation of separate Employee Stock Options Plan (ESOP) pool. This setup is known as an employee welfare trust or an employee benefits trust (EBT). Such pool is devoid of any dilution and shares shall be reserved exclusively for distribution to employees.

These shares may be acquired by the trust by subscribing to any new issue by the company or transfer by dilution of current shareholdings.

Eligible directors may also deposit the ESOP shares upon exercise; however unexercised ESOP shares are not transferable.

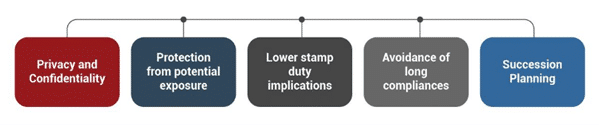

Benefits of a Trust Structure

- A private trust ensures privacy and confidentiality about the wealth of the promoter (trust- maker), from being exposed to the public. In an IPO offer document, if the shares are already transferred to the Trust, the trustee would be listed as the shareholder of the concerned shares and not the settlor.

- It acts as a custodian of the shareholdings of the individual, protecting them from claim from creditors.

- Transfer of assets to the trust prior to the IPO facilitates lower stamp duty costs on transfer of securities as the valuation is generally lower, due to differential methods or market volatility.

- A pre-IPO trust facilitates seamless wealth transition within their own legacy while avoiding extensive compliances requirement under SEBI on transfer of shares in case of uncertain events and personal exigencies.

- It ensures well planned succession planning, providing structured approach to transfer of wealth across generations, safeguarding the continuity of legacy and business.

- The public trust structure can be ideal for philanthropy objective.

Tax and Regulatory Framework

1. SEBI Regulations

- Transfer of shares by founders to the trust shall take place any time before the filing of the Draft Red Herring Prospectus by the company with SEBI. However, it shall be done well in advance so that the trustee is reflected as a member in the Register of members of the company.

- SEBI’s ICDR (Issue of Capital and Disclosure Requirements) Regulations, 2018, require promoters to hold a minimum of 20% of post-issue capital of the company known as ‘minimum promoter’s contribution’. These shares shall be retained for at least eighteen months from the date of allotment of the public issue. Private trusts established pre-IPO may form a part of ‘promoter group’, as they hold direct shareholding in the company.

- Also, as per SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 2011, an open offer shall be required for acquisition of shares (i) where acquirer intends to acquire share entitling 25% or more voting rights or (ii) acquiree holding 25% of voting rights intends to additionally acquire 5% or more voting rights in a financial year. However, exemption to make an open offer is granted in case of trust with only immediate relatives as the trustees and beneficiaries and transfer of shares is non-commercial. Thus, a pre-IPO trust has an edge over a post-IPO trust as it allows for creation of trust for the benefit of relatives as well as non-relatives, without any open offer to the public.

2. Income Tax Act, 1961

- Transfer of shares into an irrevocable trust will not be regarded as a transfer as per Section 47(iii) of the Income Tax Act, 1961. Thus, no capital gains tax will be levied in the hands of settlor.

- Similarly, trust is not liable to pay tax on receipt of such assets as per Section 56(2)(x) of the Income Tax Act, if the trust is created for benefit of relative.

3. Companies Act, 2013

Transfer of shares to the trust may be subject to:

- Approval of the board of directors of company.

- Execution of share transfer deed for effecting change of ownership.

- Issue share certificates in the name of the trust.

- Register the transfer in the company’s register of members.

4. Indian Stamp Act, 1899

Transfer of shares to the trust will attract stamp duty as per prevailing rates in the state.

Conclusion

As India’s IPO landscape widens, founders and family businesses face both tremendous opportunities and increased responsibilities. Pre-IPO trusts have emerged as a strategic safeguard—protecting promoter wealth, enabling smooth succession, and reducing compliance hurdles. On the other hand, Employee Benefit Trust (EBT) is a structured mechanism to manage ESOPs, ensuring that employee incentives provide long-term growth. For promoters and entrepreneurs, establishing such trusts before going public is a futuristic measure to preserve legacy, ensure continuity, and procure sustainable value in the public markets.

Why Choose InCorp Global?

We understand that regulatory compliance and succession planning can be complicated. Our dedicated team of family office management experts, legal professionals, tax and financial advisors who have the required knowledge and experience are happy to assist you. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Megha Gala | Family Office

FAQs

A person’s will is flexible with circumstances or under the influence of others. However, transferring assets such as shares into a trust safeguards them from such fluctuations, ensuring clear rules on the estate and an unambiguous distribution plan for beneficiaries. When carefully structured—with precise language and the informed consent of all interested parties—such trusts can provide greater certainty and legal security than a traditional last will and testament.

A private trust is taxed at MMR (maximum marginal rate) and taxed as per applicable slab rates for determinate trusts. Capital gains shall be taxed on applicable rates for capital assets based on holding conditions.

Yes, due to lower valuation of company prior to IPOs, the stamp duty shall be less compared to transfer of shares post-IPO, when the valuation is much higher.

An Indian resident cannot create an interest in favour of a non-resident. Thus, RBI approval may be required at the time of creation of the trust.

Trust structure is not recognised in many countries as a separate legal entity. Therefore, subject to interpretation of Double Tax avoidance treaties, many times, specific or non-discretionary trusts provide a tax-efficient structure, particularly when the beneficiaries are non-residents.

Trustees must file annual income tax returns, maintain proper accounts, comply with tax audit obligations, deduct and file TDS and other compliances if applicable.

A private trust or a pre-IPO trust shall get dissolved as per instructions by the settlor in the trust deed, i.e. on fulfilment of its object or tenure or non-compliance to mandatory conditions.

Share

Share