BRSR Core Assurance in India: Scope, Methodology, and Key Challenges

BRSR Core Assurance in India: Scope, Methodology, and Key Challenges

Understanding BRSR & BRSR Core: Evolution, Assurance Types, Frameworks, Adoption Strategies and Key Challenges

- Last Updated

Ethical business practices are becoming more important in an evolving corporate environment. India has made significant strides in bringing companies in compliance with national and international sustainability standards and frameworks, even as companies around the world continue to be scrutinized for their ESG impacts.

Securities and Exchange Board of India (SEBI), which established Business Responsibility and Sustainability Report (BRSR) for India’s top 1000 listed companies on both the National Stock Exchange of India Ltd (NSE) and Bombay Stock Exchange Ltd (BSE), is primarily responsible for this shift. It aims to advance accountability, openness, and ethical business practices by nudging businesses to integrate ESG factors into their business plans. BRSR Core Assurance, in particular, plays a critical role in improving the dependability and credibility of ESG data disclosed in accordance with these ESG frameworks.

Evolution of BRSR and BRSR Core

*SEBI Guideline circular dated May 2021, SEBI Guideline circular dated July 2023

|

Phased implementation of BRSR and BRSR Core |

|

|---|---|

| FY 2022-23 | Mandatory Reporting of BRSR to the Top 1000 listed entities by Market Capitalization (SEBI Guideline circular dated May 2021) |

| FY 2023-24 | The BRSR Framework was revised to include new KPIs for BRSR Core, and Reasonable Assurance of BRSR Core became mandatory for the Top 150 listed entities (SEBI Guideline circular dated July 2023) |

| FY 2024-25 | The Reasonable Assurance / Assessment of BRSR Core KPIs became mandatory for the Top 250 listed entities |

| FY 2025-26 (Current FY) | Assurance / Assessment of BRSR Core KPIs will become mandatory for the Top 500 listed entities |

| FY 2026-27 | Assurance / Assessment of BRSR Core KPIs will become mandatory for all the Top 1000 listed entities |

In the recent years, corporate sustainability reporting has gone through substantial development. In 2012, SEBI mandated Business Responsibility Report (BRR) for the top 100 listed companies to include as part of their annual reports. In 2021, BRR was replaced by the Business Responsibility and Sustainability Report (BRSR) for the top 1000 listed companies, aligned with MCA’s National Guidelines on Responsible Business Conduct (NGRBC) to assess and disclose the company’s ESG performance.

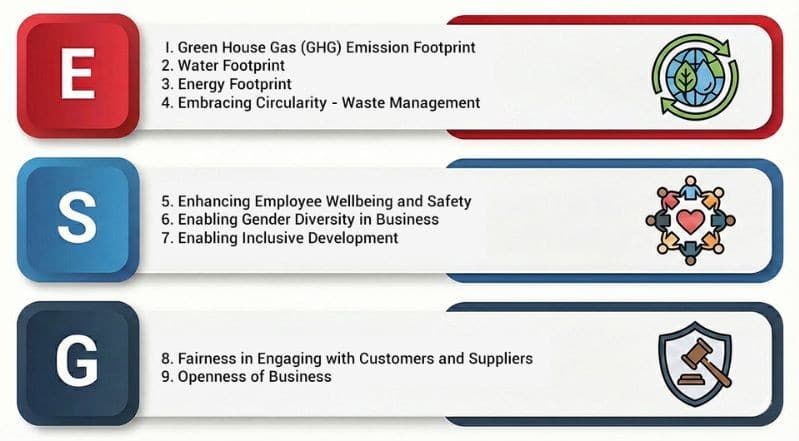

Thereafter, BRSR was revised to BRSR Core, which is a subset of the BRSR, focusing on a key 9 ESG indicators in the context of Indian and emerging markets stated below. This development has now paved a way for the phased implementation of BRSR Core Assurance, which means the data reported will be validated by third-party assurance providers to enhance credibility and accuracy.

Types of Assurance

There are mainly two types of assurance processes:

1.Internal Assurance

This encompasses procedures within an organization that evaluate the efficiency of its operations and reporting validity. Usually carried out by management or a qualified consultant, it encompasses functions such as internal audits, management reviews, validation of reports, as well as control self-assessments. The aim of this procedure is to assess and enhance internal controls, risk management, and governance.

2. External Assurance

It refers to the independent validation of an organization’s activities and its reporting for the purpose of increasing stakeholder confidence.

External assurance is subdivided into:

- Reasonable Assurance: This is a detailed investigation through which practitioner collects evidence to a level that reduces risk to an acceptable amount and bases an opinion on criteria. The conclusion is affirmative and states that management representations are fairly stated.

- Limited Assurance: In this type of assurance engagement, the process involves fewer procedures than reasonable assurance engagement and is based on satisfying a substantive level of confidence. The results are negative and imply that there is no material doubt over the fairness of management’s presentation due to the work that has been carried out.

Assurance Frameworks Relevant to BRSR Core

In India, the assurance for BRSR Core is given in compliance with the national and internationally accepted assurance standards, ensuring that the assurance received is satisfactorily acceptable.

1. SSAE 3000 (Standard on Sustainability Assurance Engagements)

- The Sustainability Reporting Standards Board (SRSB) of the Institute of Chartered Accountants of India (ICAI) has issued the Standard on Sustainability Assurance Engagements (SSAE) 3000.

- Effective from March 31, 2024, SSAE 3000 has acknowledged the growing trend of accountability toward sustainability issues based on the Indian scenario.

2. ISAE 3000 (International Standard on Assurance Engagements)

- The International Standard on Assurance Engagements (ISAE) 3000 issued by International Auditing and Assurance Standards Board (IAASB) is the standard that is being applied to non-financial assurance engagements, as well as sustainability reporting.

- In Indian context, the ISAE 3000 assurance standard facilitates adherence to the international best practices for assurance approaches, which, at the same time, addresses the requirements for ESG reporting in the business environment.

3. ISSA 5000 (International Standard for Sustainability Assurance)

- ISSA 5000 extends the principles of International Standard for Assurance Engagements (ISAE) 3000 on Greenhouse Gas (GHG) Statements to specifically address the complexities of sustainability assurance issued by IAASB in November 2024.

- As opposed to the conventional financial audit, it serves the process of evaluation of ESG data. ISSA 5000 applicability for sustainability information is effective for periods beginning on or after December 15, 2026, and for reporting 2027 onwards.

4. IFRS S1 & S2 (International Financial Reporting Standards for Sustainability)

- IFRS S1 & S2 is prepared by the International Sustainability Standards Board (ISSB). The IFRS S1 applies to general disclosures about sustainability issues, whereas IFRS S2 applies to climate-related issues.

- IFRS S1 and S2 adoption is gradually becoming important in the Indian context.

How can Companies Adopt BRSR Assurance?

- Conduct a gap analysis to identify shortcomings in current BRSR disclosures and assurance readiness.

- Define clear ESG vision and objectives, supported by robust governance to embed sustainability into business strategy and decision-making.

- Establish SOPs for controls, data collection, assumptions, and methodologies to ensure assurance-ready BRSR data.

- Train relevant teams on BRSR requirements, assurance expectation, and data ownership.

- Identify early involvement of internal/external assurance providers.

- Strengthen data accuracy through source-level data collection, validation, documentation, and audit trails.

- Perform internal validations or dry runs to identify gaps before external assurance.

- Align assurance timelines with the BRSR reporting cycle to avoid last-minute issues.

- Leverage assurance insights to refine processes, improve data quality, and stay aligned with evolving standards.

Key Challenges in BRSR Core Assurance

While it has been two years since BRSR assurance was introduced, companies still face several challenges in meeting the requirements. Those top 5 challenges include:

- Lack of Standardization: In the context of BRSR Core disclosures, there may be variability in the collection of data for similar KPIs. This makes it complex for companies to develop uniformity and standardization across their reporting processes.

- Data Quality and Availability: In most companies, the capacity to handle the requisite information to verify ESG data is not present. In such scenarios, the challenge of offering an independent view regarding the information may arise.

- Lack of Awareness within Teams: In most cases, there can be a lack of awareness, training and understanding of the ESG data and the need for data verification among internal team.

- Lack of Documentation: Missing monthly records and last-minute documentation may pose difficulties in the process of assurance resulting in unexpected delays.

- Data completeness: There is a possibility that companies may not capture the complete set of ESG data. Without operational visibility, consideration cannot be given to each facet of ESG reporting.

Conclusion

The implementation of BRSR Core Assurance marks an important milestone in improving transparencies of ESG disclosures reported by a company. However, like every developing framework, the BRSR Core Assurance has also encountered some challenges. Nevertheless, as the Indian corporate sector becomes increasingly adaptive to the sustainability cause, the BRSR Core Assurance will be an essential part of increasing trust and aligning Indian companies with worldwide sustainability aims.

Why Choose InCorp Global?

InCorp offers a holistic ecosystem and support service for your BRSR Assurance requirements. Our experts perform a 360-degree evaluation to identify and point out possible risks and opportunities which might emerge during BRSR assurance. If you would like to know more about the details involving BRSR Assurance or ESG, you can write to us at info@incorpadvisory.in or WhatsApp us on (+91) 77380 66622.

Authored by:

Aman Rastogi | Sustainability & ESG

FAQs

BRSR assurance refers to the review of ESG disclosures through an independent third-party assurer, which provides stakeholders with a reasonable belief on those disclosures. It enhances corporate transparency by verifying that the reported data is accurate.

It is increasingly becoming a key regulatory and mandatory requirement for top 1000 listed companies in India by FY 2026-27.

Key components include verification of ESG data, assessment of reporting practices, governance and risk management and lastly the compliance checks.

The independent auditors ensure that the ESG data presented conforms to the standards of BRSR through review and verification, drawing attention to discrepancies and enabling businesses to enhance the accuracy and transparency of their reporting.

BRSR assurance helps to enhance the level of stakeholders’ trust through the verification of claims on ESG issues, which shows a commitment to transparency, making it easier for investors to rely on information for investment purposes.

Share

Share